Alex Hormozi's $100M Money Models: Summary + Access to the Course and Audiobook

Breaking News: This framework just shattered the Guinness World Record for fastest-selling non-fiction book in history - 2.5+ million copies in 24 hours, beating records held by Michelle Obama, Barack Obama, and Prince Harry. Here's the exact system that made it possible.

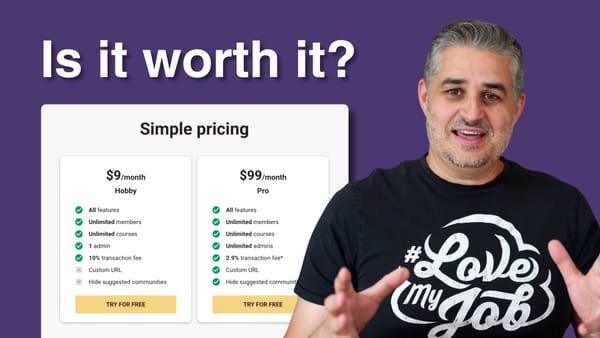

Grab your Free 14-day Skool Trial here.

All the links in this article are referral links. Thank you for supporting me 🙏

Access the $100M Money Models Course and Audiobook for Free!

💡This is a summary of Alex Hormozi's $100M Money Models live stream.

The $250 Million Problem Every Business Owner Faces

Picture this: You're working 80-hour weeks, missing family dinners, taking on more risk than any reasonable person should - and at the end of the year, you're making less than San Francisco's minimum wage.

This isn't hyperbole. According to 2024 Census Bureau data, the median income for business owners is just $48,000 per year. Meanwhile, 82% of businesses fail due to one simple reason: poor cash flow.

Alex Hormozi witnessed this painful reality firsthand while sleeping on the floor of his gym, down to his last $1,000. Ten years later, his portfolio companies generate over $250 million annually. The difference? He discovered how to engineer money models that make businesses impossible to kill.

The Money Model Equation That Changes Everything

At its core, Hormozi's framework relies on one deceptively simple equation:

30-day gross profit > 2 × (CAC + COGS)

In plain English: Each customer should bring you at least twice the money of what it cost you to acquire and serve them within 30 days.

When you achieve this, something magical happens - you remove cash as a limiter for growth. Every customer essentially pays for themselves and the next customer, creating a self-funding growth engine.

The Four Systems That Determine Your Success

After working directly with 1,026+ businesses and conducting 226 one-on-one consultations (at $135,000 each), Hormozi discovered that every business constraint falls into one of four systems:

System 1: Lead System Constraints

Symptoms:

- Can't get enough qualified prospects

- Hitting ad spend ceilings

- CPAs going crazy

- Content not converting

- Leads cost too much

Diagnostic Question: "Do you have enough people to sell to?"

System 2: Sales System Constraints

Symptoms:

- Show rates below 70%

- Your team closes at 20-30% while you close at 80%

- Sales cycles taking multiple conversations

- No proof at the right times

- Giving panic discounts

Diagnostic Question: "Are you converting the prospects you have?"

System 3: Delivery System Constraints

Symptoms:

- Customers aren't worth enough (low LTV)

- Churn above 3% monthly

- Can't retain customers long enough

- People quit after first purchase

- No repeat buyers

Diagnostic Question: "Do customers stay and buy again?"

System 4: Profit System Constraints

Symptoms:

- Working all day for small margins

- Can't afford to compete on ad spend

- Stuck in the "swamp of success" at $1-3M

- Good revenue but no cash in bank

- Can't afford A-players

Diagnostic Question: "Does your bank account reflect your hard work?"

Access the $100M Money Models Course and Audiobook for Free!

The 15 Money Model Mechanisms That Scale Any Business

Money models use four powerful mechanism categories, each containing specific tactics that can transform your business overnight:

Attraction Offers (Get People to Buy)

- Win Your Money BackReal Example: Hormozi's gym went from $300 CAC with 3-month payback to immediate positive cash flow using this mechanism

- Customer pays full price upfront

- Works toward specific goal with your help

- Gets money back (or as credit) when goal achieved

- Result: Insane engagement, reviews, and referrals

- Giveaways

- 7-day structured contest that creates buying urgency

- Pre-qualifies high-intent buyers

- Floods business with people ready for premium offers

- Dummy Offer

- Present premium option first

- Makes core offer feel like incredible value

- Turns browsers into buyers through contrast

- Buy X Get Y Free

- Quantity multiplier for immediate cash

- Transforms discounts into irresistible free offers

- Works for products or months of service

- Pay Less Now or Pay More Later

- Early bird pricing that accelerates purchase timing

- Creates genuine urgency without being pushy

- Gets customers choosing higher value offers now

Upsell Offers (Get Them to Buy More)

- Classic Upsells (Problem Reveal)

- First purchase reveals need for next solution

- Customer sells themselves without pressure

- Natural progression that feels helpful, not salesy

- Menu UpsellsLive Example: Prestige Labs went from $270K/month to $1.6M/month in 8 weeks using menu upsells

- Consultative approach: "Here's what you need, here's what you don't"

- Builds massive trust

- Customers buy more expensive items and feel grateful

- Anchor Upsells

- Present high-priced option first

- Core offer appears incredibly affordable

- Customers relieved to pay more than planned

- Rollover UpsellsLive Coaching Example: Equestrian fitness company should credit $3K program toward $10K backend, showing $7K price while actually increasing revenue

- Credit first purchase toward larger package

- Transforms new customers into highest-paying clients

- Creates perception of huge discount while increasing revenue

Downsell Offers (Turn No into Yes)

- Payment Plan Downsells

- Addresses "can't afford it" without lowering price

- Algorithm for optimal payment chunking

- Maximizes both purchases and cash flow

- Trial Downsells

- "Skin in the game" approach (not free)

- Customers prove value to themselves

- Converts proven users into buyers

- Feature Downsells

- Strip optional features for affordability

- Custom-fit offer to budget

- Balance price vs. value for maximum conversion

Continuity Offers (Get Them to Buy Repeatedly)

- Bonus ContinuityReal Example: This mechanism took Gym Launch from $380K/month to $1.76M/month in 6 months

- Give valuable bonus ONLY if they join recurring

- Bonus worth more than first payment

- Makes first month feel "better than free"

- Discount Continuity

- Structure discounts for longer commitments

- Five sub-mechanisms for different business types

- Gets annual prepayments while feeling like a steal

- Waive-Fee Continuity

- Flexibility costs more

- Commitment removes fees

- Works especially well for high-onboarding businesses

Access the $100M Money Models Course and Audiobook for Free!

Real-World Implementation: Live Case Studies from the Launch

During the record-breaking launch, Hormozi conducted live coaching sessions that revealed exactly how to apply money models to different businesses:

Case Study 1: Dance Studio Transformation

Business: $650K revenue, 50% margins, 50% renewal rate

Problem: Low retention killing LTV

Solution:

- Focus on getting to 3% monthly churn (38-month average retention)

- Implement rollover offers from beginner to intermediate

- Stop obsessing over close rates, fix the retention bucket first

Key Insight: "If you can get people to stay for 3 years instead of 6 months, it changes everything"

Case Study 2: E-commerce Murphy Beds Scale

Business: $48M revenue, 60% YoY growth

Problem: Wondering whether to expand channels or double down

Solution:

- "Do more before new" - scale existing channels first

- Adding sales team already increased AOV from $2,200 to $2,800

- Don't add complexity when current model has room to grow

Result: Focus on scaling ads with improved unit economics from sales team

Case Study 3: Pizza Restaurant Decision

Business: $2.4M revenue, 35% margins, 22-year-old owner

Problem: Considering pivoting to "more scalable" model

Solution:

- Keep doubling down on working model

- Open locations by taking over failing ice cream parlors (lower capital requirements)

- Don't pivot because others seem to scale faster

Framework: "Harder now, easier later. Easier now, harder later."

Case Study 4: Insurance/Regulated Industry Breakthrough

Business: Dental office with insurance constraints

Solution:

- Focus on operational excellence

- Find all billable services within regulations

- Master the billing system completely

- Create better patient journey for higher LTV within constraints

Access the $100M Money Models Course and Audiobook for Free!

The 90-Day Implementation Playbook

Days 0-30: Diagnose and Quick Wins

Week 1: Run Constraint Analysis

- Identify which of the four systems is your bottleneck

- Use diagnostic questions to pinpoint exact issues

- Choose ONE system to focus on first

Weeks 2-4: Implement Quick Wins

- If Lead-Constrained: Build hook swipe file, test 2 ad creatives, measure EPC

- If Sales-Constrained: Add multi-channel nurture sequence, train team on one universal close

- If Delivery-Constrained: Add one rollover offer or continuity product

- If Profit-Constrained: Raise prices 20% minimum, run one fast cash campaign

Days 31-60: Scale the Wins

Week 5-6: Double Down

- Take winning ad creative and scale media spend within ROAS rules

- Standardize successful sales scripts across team

- Automate winning nurture sequences

Week 7-8: Optimize

- A/B test payment plans on best offers

- Role-play the 7 universal closes daily

- Create milestone check-ins for retention

Days 61-90: Institutionalize

Week 9-10: Systematize

- Codify winning ads into creative templates

- Create playbooks for new hires

- Install weekly KPI dashboards

Week 11-12: Plan Next Quarter

- Schedule quarterly fast cash campaigns

- Plan next price increase

- Map out Q2 constraint to tackle

The Decision Frameworks That Create Millionaires

Throughout the launch, Hormozi shared the ten decisions and frameworks that took him from sleeping on a gym floor to running a $250M portfolio:

Framework 1: "If You Risk Nothing, You Get Nothing"

The only guarantee in business is that playing it safe guarantees mediocrity.

Framework 2: The Three Questions Test

Before any investment, ask:

- Will this get me closer to my goals?

- Does it increase my chances versus doing it alone?

- Do I have access to the money?

If yes to all three, it's a logical decision.

Framework 3: "You're Going to Buy These Lessons Either Way"

You pay with time or money, but only one you can get back.

Framework 4: Resources vs. Resourcefulness

Jamie, a single mom with 4 kids, taught Hormozi this driving Uber one day a week to afford training. There's always someone who had it worse and did better.

Framework 5: The Asymmetric Bet Framework

"If it doesn't work out, it changes nothing. If it does, it changes everything."

Advanced Strategies from the Trenches

The "Special Snowflake-itis" Cure

Hormozi's blunt truth: "While there might be nuances to your business, the fundamental principles of cash flow remain the same across all businesses. There's only four ways to sell stuff and money models work in all of them."

Pricing Psychology Mastery

- 28-Day Billing Cycle: Switch from monthly to 28-day = instant 8.3% revenue increase

- Duration Elimination: "If I could pull your tooth in 60 seconds vs. an hour, which would you prefer?"

- Anchor Strategy: Present $10K option so $3K feels like relief

The "Boxes Not People" Organization Framework

When restructuring:

- Design future state with boxes (roles) not people

- Map current people to boxes

- Separate decision from communication

- Make the business decision first, then plan the conversation

The "Cell Phone Speech" for Delegation

"When something happens, this phone doesn't ring. Someone falls and breaks their back - what do you do? If your answer is 'call me,' wrong answer. That's what I'm paying you to prevent."

Common Objections Destroyed

"This won't work in my regulated industry"

Insurance companies using these frameworks went from 20% to 61% appointment conversion. Dental offices increased revenue within insurance constraints. The principles adapt to any rules.

"I don't have money for ads"

The launch started with $22,000 and scaled to $4 million using house money. You don't need millions - you need a money model that generates cash from day one.

"My business is different"

There are only four types of products (software, information, services, physical) and four ways to sell (online/offline, with/without salesperson). Money models work for all 16 combinations.

"Changing prices will lose customers"

Hundreds of businesses report 20-78% price increases with minimal customer loss when using the Price Raise Letter framework. Most customers accept fair increases when value is clear.

Access the $100M Money Models Course and Audiobook for Free!

The Talent and Team Revelation

The A-Player Economy

"Your job is to set up a lucrative business model, then take profits and hire A-players. That's the entire cycle."

Key insights:

- A-players cost 10-30% more but deliver 10x results

- Pay above market (85th percentile) to attract them

- Keep incentive plans simple: base + profit share

- Use OTE (On-Target Earnings) to reverse-engineer compensation

The Business of Talent

For service businesses (salons, clinics, agencies): "You're not in the business of [service], you're in the business of talent. You're competing against their ability to go solo."

Measuring Success: The Only Metrics That Matter

The Core Equation

LTV:CAC Ratio

- Minimum viable: 3:1

- Good: 5:1

- Excellent: 10:1+

The Speed Metric

30-Day Cash Multiplier

- Breaking even in 30 days = sustainable

- 2x in 30 days = scalable

- 3x+ in 30 days = unstoppable

The Retention Standard

Monthly Churn Rate

- Above 10% = Emergency

- 5-10% = Fixable

- 3-5% = Acceptable

- Below 3% = Excellent

Your Next Steps: From Theory to $100M

Step 1: Diagnose Your Constraint (Today)

Run through the four systems. Which one is bleeding the most?

Step 2: Pick One Mechanism (This Week)

Don't try all 15. Pick the ONE that addresses your biggest constraint.

Step 3: Implement the Playbook (Next 30 Days)

Follow the exact 90-day playbook above. No modifications for the first round.

Step 4: Measure and Iterate (Days 31-90)

Track your 30-day cash multiplier weekly. Adjust based on data, not feelings.

Step 5: Scale What Works (Day 91+)

Once you crack 2x in 30 days, pour gasoline on the fire.

The Bottom Line: Why This Matters Now

The business landscape has fundamentally changed. In Hormozi's words from the launch:

"In a world where no one trusts anyone, brand is going to be the moat. The difference between small business owners and big business owners is their understanding of branding and money models."

But here's what makes this moment unique: For the first time in history, an entrepreneur (not a politician) holds the record for fastest-selling non-fiction book. This isn't just about one person's success - it's proof that entrepreneurial education has reached a tipping point.

The 2.5 million entrepreneurs who bought this book in 24 hours aren't just learning theory. They're implementing systems that generated $250 million in portfolio revenue last year alone.

The Mission: 32.5 Million Entrepreneurs

Hormozi's mission extends beyond individual success: Get these frameworks into the hands of all 32.5 million American entrepreneurs. Why? Because entrepreneurs provide the jobs, create innovation, and fuel the economy. Yet they take the most risk, pay the most taxes, and work the longest hours.

As Hormozi said during the launch while breaking down: "Everything I have is because of things I learned from others who decided to write it down. If I can save you even 10% of the pain I went through, it's worth it."

The difference between businesses that explode and businesses that die isn't working harder. It's understanding how to make customers worth more than they cost to acquire - and doing it fast enough to fund growth.

That's not marketing speak. That's math. And now you have the equation.

Note: Results vary by business and individual effort. The examples and case studies presented are from actual businesses but do not guarantee similar outcomes. All business involves risk.

Ready to implement? The framework that broke a world record is now yours. The only question: Will you be one of the entrepreneurs who actually uses it?

Access the $100M Money Models Course and Audiobook for Free!

Frequently Asked Questions (Q&A)

Q: What is the core equation in Hormozi's money model framework?

A: The core equation is: 30-day gross profit > 2 × (CAC + COGS). This means each customer should generate at least twice the profit in 30 days compared to the cost to acquire and serve them, enabling self-sustaining growth.

Q: How do I identify my business's main constraint?

A: Use the four diagnostic questions for the systems: Lead (Do you have enough people to sell to?), Sales (Are you converting the prospects you have?), Delivery (Do customers stay and buy again?), and Profit (Does your bank account reflect your hard work?). Focus on the one that's the biggest bottleneck.

Q: Can these money models work for regulated industries like insurance or healthcare?

A: Yes, the principles adapt to regulations. For example, dental offices have increased revenue by mastering billing systems and improving patient journeys within constraints, and insurance companies improved appointment conversions from 20% to 61%.

Q: What if I don't have a big budget for advertising?

A: You don't need a large budget to start. Hormozi's launch began with $22,000 and scaled to $4 million using generated cash flow. Focus on money models that create immediate positive cash from day one.

Q: How should I handle price increases without losing customers?

A: Use the Price Raise Letter framework to communicate value clearly. Businesses have reported 20-78% price increases with minimal loss, as customers accept fair changes when the value is evident.

Q: What's the best way to start implementing these mechanisms?

A: Follow the 90-day playbook: Diagnose your constraint in week 1, implement quick wins in weeks 2-4, scale in days 31-60, and institutionalize in days 61-90. Start with just one mechanism that addresses your biggest issue.

Q: How important is retention in this framework?

A: Extremely important. Aim for below 3% monthly churn for excellent results. Improving retention from 6 months to 3 years can dramatically increase LTV and change your business entirely.

Q: What metrics should I track for success?

A: Key metrics include LTV:CAC ratio (aim for 5:1 or better), 30-day cash multiplier (2x for scalable), and monthly churn rate (below 3% is excellent). Track these weekly to iterate based on data.

Grab your Free 14-day Skool Trial here.

All the links in this article are referral links. Thank you for supporting me 🙏